Media Center

UAE Cabinet to expand list of excise taxable products, reducing consumption of unhealthy goods

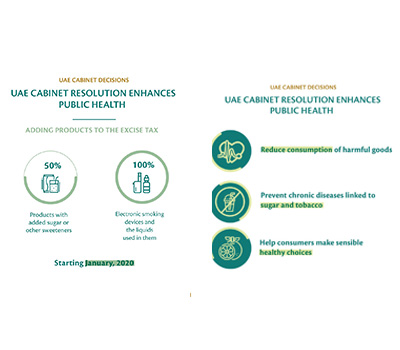

In a step to reduce consumption of unhealthy goods and modify consumers’ behavior, the UAE Cabinet adopted a decision to expand the list of excise taxable products to include sweetened beverages, sugary drinks and electronic smoking devices, starting January 1, 2020.

The decision comes to support the UAE government's efforts to enhance public health and prevent chronic diseases directly linked to sugar and tobacco consumption.

A tax of 50% will be levied on any product with added sugar or other sweeteners, whether in form of a beverage, liquid, concentrate, powders, extracts or any product that may be converted into a drink. The decision also requires manufacturers to clearly identify the sugar content in order for consumers to make sensible healthy choices.

A tax of 100% will be also levied on electronic smoking devices, whether or not they contain nicotine or tobacco, as well as the liquids used in electronic smoking devices. The decision aims at reducing the consumption of harmful products that put the health of people and environment at risk.

In 2017, the UAE Government started introducing excise tax on specific goods, which are typically harmful to human health or the environment.